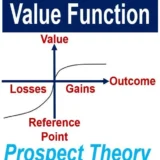

Prospect Theory is a behavioral economics and behavioral finance theory formulated by Daniel Kahneman and Amos Tversky in 1979. The theory argues that individuals value losses and gains differently that is why they make decisions based on perceived gains instead of perceived losse. It assumes given two choices, both equal, but one with potential gains and the other in terms of potential losses, individuals will choose the former. Tversky and Kahneman proposed that losses cause a greater emotional impact on an individual than does an equivalent amount of gain. Prospect theory is part of behavioral economics, suggesting investors choose perceived gains because losses cause a greater emotional impact. The certainty effect argues that individuals prefer certain outcomes over probable ones. The isolation effect opines that individuals cancel out similar information when making a decision.

According to the prospect theory, decisions follow a two-stage process the editing phase and the evaluation phase. The editing phase is where decision-makers use mental shortcuts to assess which information is important and what options are available. It is also in this phase that they decide the likely outcomes and rank priorities. The evaluation phase is where people make final decisions, based on the assessments made in the editing phase. The actions taken are based on the perceived likelihood and desirability of each outcome. Prospect Theory argues that people tend to be risk-averse when the stakes are high, and risk-accepting when the stakes are low. This explains why they make choices that minimize losses rather than maximize expected gains. Additionally, humans prefer certainties over probabilities. Moreover, proponents of this theory believe that people underestimate outcomes with a low probability. It help individuals to overcome biases and make more rational choices. It reframes possible outcomes in a way that reduces the impact of cognitive biases.